Trip Logbook Mileage Tracker – IRS Compliant

Trip Logbook helps U.S. users generate accurate mileage logs that follow the IRS record-keeping requirements for claiming business mileage deductions.

What “IRS Compliant” Really Means

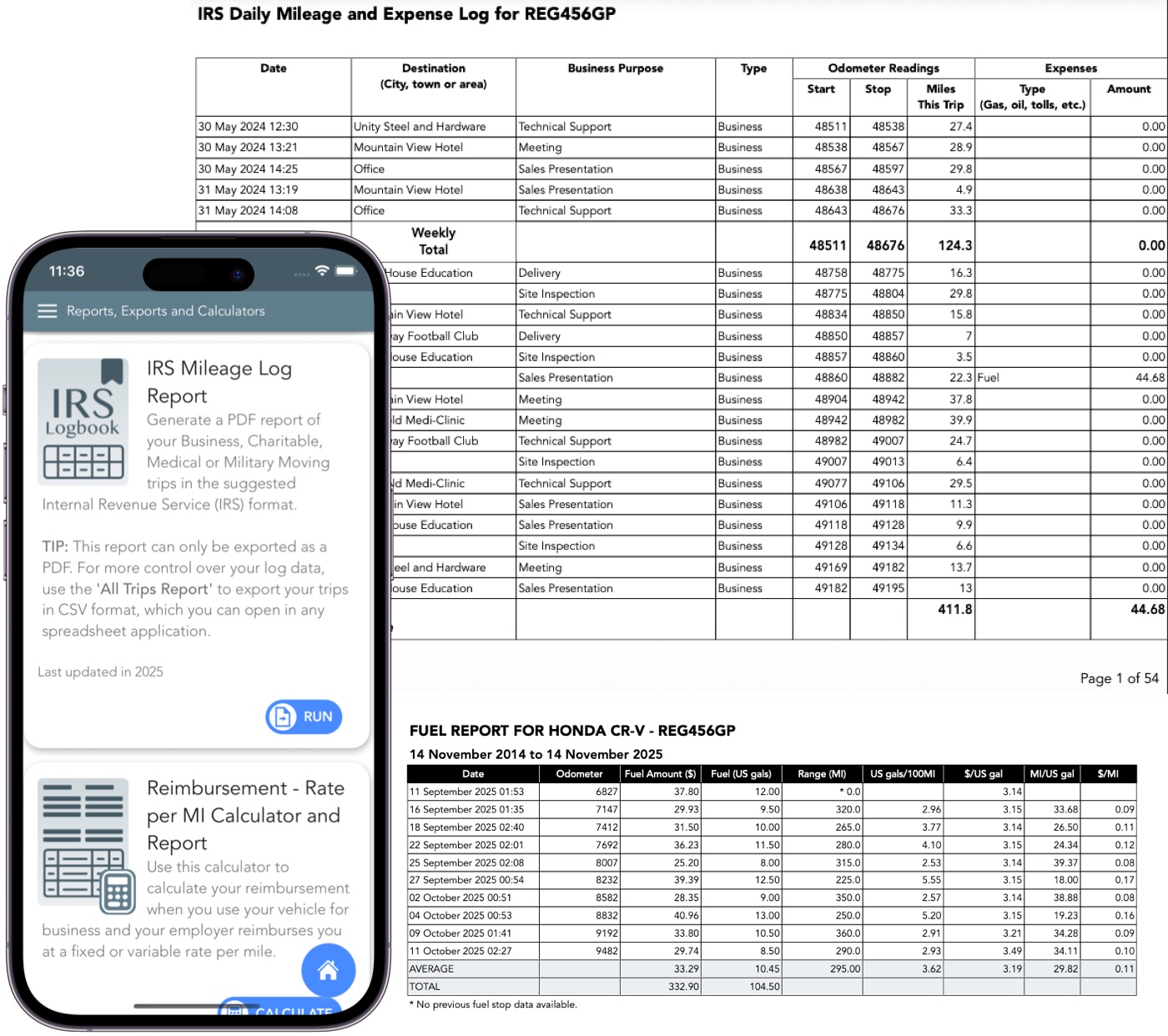

The IRS does not approve or certify apps. Instead, it sets record-keeping rules for mileage logs. A mileage log is considered IRS compliant when it contains:

- The date of each trip

- The starting point

- The destination

- The business purpose of the trip

- Starting and ending odometer readings

- Total distance for the trip

Trip Logbook records all of these details automatically or with minimal user input.

How Trip Logbook Helps You Stay IRS Compliant

Trip Logbook is designed to capture accurate, verifiable mileage data. It includes:

- Automatic GPS tracking with manual correction options

- Odometer-based tracking for higher accuracy

- Editable trip reason and trip type

- CSV export for accountants and tax software

- Accurate timestamps (start/end)

- Fuel entry recording requiring correct odometer input

Because the app requires accurate odometer readings for fuel tracking and statistics, your mileage history naturally remains consistent — which is essential for IRS audit readiness.

Why IRS Users Trust Trip Logbook

Trip Logbook was originally designed to meet the strict requirements of the South African Revenue Service (SARS), which are more detailed than IRS guidelines. As a result, the data recorded by Trip Logbook naturally exceeds IRS documentation standards.

Export Your Mileage Log

You can export your trips in CSV format for use with:

- Spreadsheet programs such as Microsoft Excel, Apple Numbers, Google Sheets

- Your accountant

- Tax preparation software

- Personal record-keeping

All exports include the fields required by the IRS, such as trip dates, business purpose, odometer readings, and total distance.

Before submitting mileage claims, users should always review and validate their logs— a standard requirement for all IRS mileage trackers.

Built for Accuracy

Trip Logbook is engineered for drivers who value accuracy and reliability. The app:

- Runs consistently

- Tracks trips without gaps

- Allows corrections before export

- Prevents odometer inconsistencies

Whether you track mileage for business, reimbursement, or tax deductions, Trip Logbook provides the structure the IRS requires in a clean and reliable format.

Try Trip Logbook

Download Trip Logbook in the US Apple App Store and start capturing compliant mileage today.

We offer a full access 30 day free trial.

Tap or click here to download: